Credit Card Scam

Credit Card Scam – Researched by Alicia Moss

Beware!! This phone credit card scam is pretty slick because they provide YOU with all the information – except for the one number they want.

Note, the phone callers do not ask for your card number; they already have it.

This information is worth reading. By understanding how the VISA & MasterCard Telephone Credit Card Scam works, you’ll be better prepared to protect yourself.

Case Study

One of our employees was called on

Wednesday from ‘VISA’ and I was called on Thursday from ‘MasterCard’.

The scam works like this: Person calling says, ‘This is (name) and I’m calling from the Security and Fraud Department at VISA.

My badge number is 12460. Your card has been flagged for an unusual purchase pattern, and I’m calling to verify.

This would be on your VISA card which was issued by (name of bank) did you

purchase an Anti-Telemarketing Device for $497.99 from a Marketing company based in London?’ When you say ‘No’, the caller continues with, ‘Then we will be issuing a credit to your account. This

is a company we have been watching and the charges range from $297 to $497, just under the $500 purchase pattern that flags most cards.

Before your next statement, the credit will be sent to

(gives you your address), is that correct?’ You say ‘yes’. The caller continues – ‘I will be starting a fraud investigation.

If you have any questions, you should call the 0800 number listed on

the back of your card (0800-VISA) and ask for Security’.

You will need to refer to this Control Number. The caller then gives you a 6-digit number. ‘Do you need me to read it again?’ Here’s

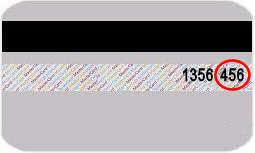

the IMPORTANT part on how the scam works the caller then says, ‘I need to verify you are in possession of your card.’ Hell ask you to ‘turn your card over and look for some numbers.’ There are 7

numbers; the first 4 are part of your card number, the next 3 are the security numbers that verify you are the possessor of the card. (See 456 ringed on the picture to the right)

These are the numbers you sometimes use to make Internet

purchases to prove you have the card. The caller will ask you to read the 3 numbers to him. After you tell the caller the 3 numbers, He’ll say, ‘That is correct, I just needed to verify that the

card has not been lost or stolen, and that you still have your card.

Do you have any other questions?’ After you say, ‘No,’ the caller then thanks you and states, ‘Don’t hesitate to call back if

you do’, and hangs up.

You actually say very little, and they never ask for or tell you the Card number. But after we were called on Wednesday, we called back within 20 minutes to ask a

question. Are we glad we did! The REAL VISA Security Department told us it was a scam and in the last 15 minutes a new purchase of $497.99 was charged to our card.

Long story — short — we made

a real fraud report and closed the VISA account. VISA is reissuing us a new number. What the scanners want is the 3-digit PIN number on the back of the card. Don’t give it to them.

Instead,

tell them you’ll call VISA or MasterCard directly for verification of their conversation. The real VISA told us that they will never ask for anything on the card as they already know the

information since they issued the card! If you give the scanners your 3 Digit PIN Number, you think you’re receiving a credit. However, by the time you get your statement you’ll see charges for

purchases you didn’t make, and by then it’s almost too late and/or more difficult to actually file a fraud report.

What makes this more remarkable is that on Thursday, I got a call from a

‘Jason Richardson of MasterCard’ with a word-for-word repeat of the VISA scam. This time I didn’t let him finish. I hung up! We filed a police report, as instructed by VISA. The police said they are

taking several of these reports daily! They also urged us to tell everybody we know that this scam is happening.

Provenance, Research of this Credit Card Scam Report

1) Is the Scam technically possible. Yes

a) People could get your credit card number from a discarded slip (unless you shred them all).

b) Anyone could phone you if your number is in the

phone book / directory.

2) Has the scam actually happened? Probably

Credit card companies almost never publicise such scams for fear of copy-cats. This is a real dilemma, but we

think that knowledge is power, forewarned is forearmed. Thus pass this url to all your family and friends. By informing each other,

we protect each other.

3) When did the scam start?

Internet research reveals the earliest cases of this particular credit card scam were in 1997. Furthermore, there have been a steady trickle of reports since then.

See more on internet memes.

4) What can you do to protect yourself?

a) Our best advice is to get into the habit of asking people who phone you from banks or credit card companies to identify themselves at the beginning of the conversation. Ask for a

number to ring them back. Check that number with phone book.

b) Other nuances that could indicate a scam. If your phone handset has caller id, check the incoming number.

c) This is reverse

sexism, but research shows that women are poorer liars and less likely to be dishonest, therefore a male voice may heighten your alert.

Snopes

say this Credit Card Scam is true.

See more urban myths, hoaxes, imposters and fakers

•

Urban Myths •

Grammy Gordon •

Smithsonian Barbie exhibit •

Piltdown Man

•

Spaghetti trees

•

Traffic ticket •

April Fools day hoaxes

•

Credit card scam •

Letter •

View space